Early 2025 has delivered a plot twist for global investors. After years of U.S. stock market dominance, capital is suddenly rotating out of American equities and into European markets. Money managers and retail traders alike are grappling with a stark performance gap: Wall Street is stumbling while Europe soars. Here we’ll break down what’s driving this transatlantic shift, backed by data and charts, and explore its implications for investors.

U.S. Equities Slump as Europe Shines YTD in 2025

YTD 2025 equity performance: U.S. benchmarks are in the red, while many European markets and ETFs boast double-digit gains.

The divergence in returns so far in 2025 is striking. By mid-March, the S&P 500 had slumped roughly 5–7% year-to-date and the tech-heavy Nasdaq was down even more, erasing the U.S. market’s early January gains. In contrast, European equities took off. The broad STOXX Europe 600 index climbed to all-time highs, up nearly 9–14% for the year depending on the benchmark. Country-specific European ETFs tell the story even more vividly: Poland’s market (EPOL) surged about 25% YTD, Austria (EWO) jumped over 24%, and Spain (EWP) rallied 13%+. This clear performance gap – U.S. stocks in the red vs. Europe solidly green – has been the widest in over a decade and has caught investors’ attention worldwide.

Importantly, these price moves align with where capital is flowing. Fund flow data shows investors voting with their feet: U.S. equity funds have seen sizable outflows in early 2025, while European funds are attracting fresh money. In fact, U.S. stock funds suffered a $33.5 billion net withdrawal in just one week of March, the largest weekly outflow in three months. At the same time, cash has been pouring into Europe-focused equity funds. During the third week of February, Europe equity funds recorded their biggest inflow since early 2022, and by mid-March they extended their longest inflow streak since 2021 . In one March week alone, nearly $4.9 billion flowed into European stock funds as investors increased their allocations to the continent. Clearly, the rotation out of U.S. markets and into Europe is not just talk – it’s showing up in the money movements.

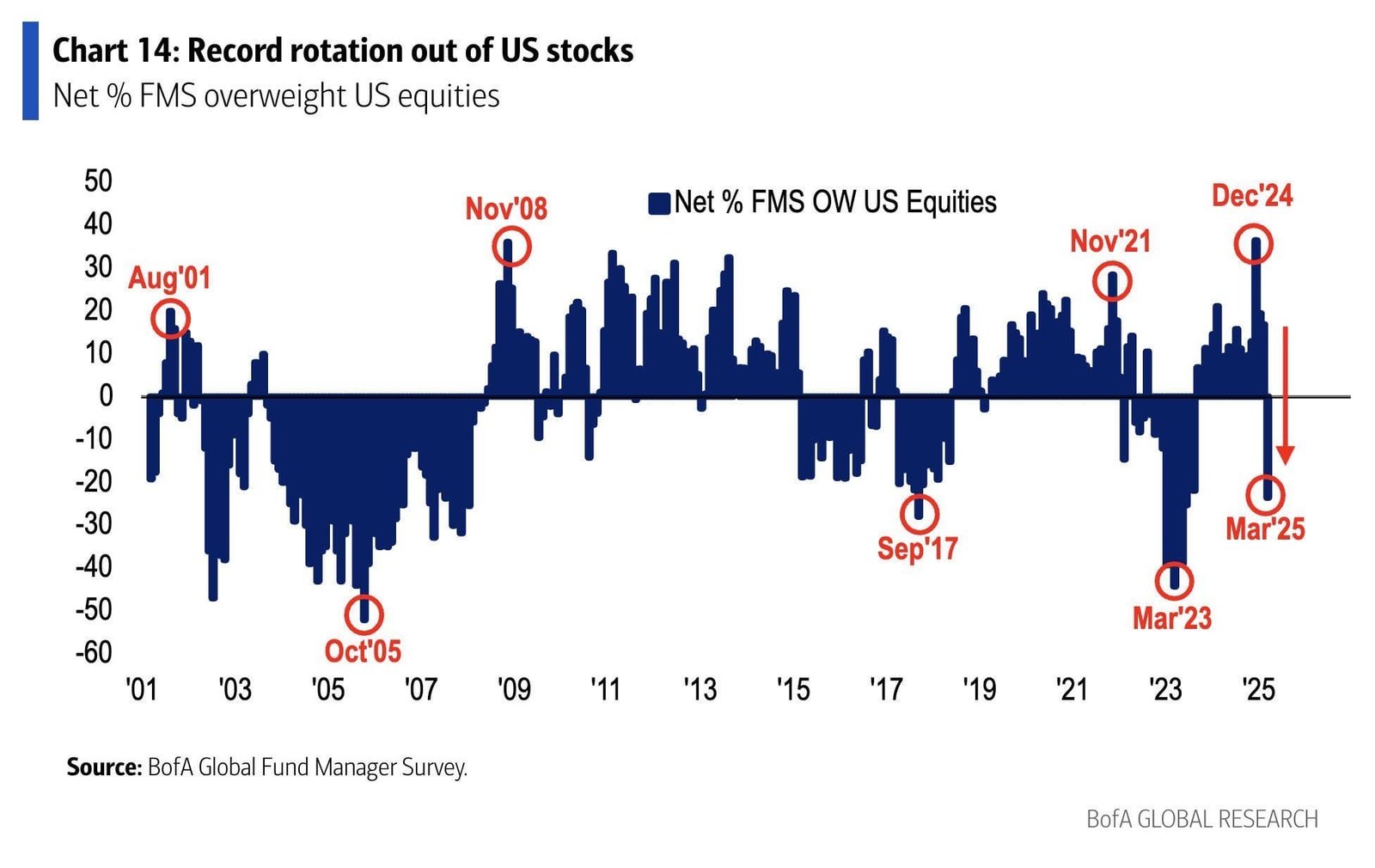

Record Drop in U.S. Stock Allocation (BofA Survey Signals Capitulation)

Global Fund Manager Survey (March 2025): U.S. equity allocation saw its sharpest one-month drop on record, as managers massively cut exposure.

Institutional investors are leading this charge. Bank of America’s March 2025 Global Fund Manager Survey – a closely watched gauge of professional investor positioning – revealed a historic swing away from U.S. equities. According to the survey, the net percentage of fund managers overweight U.S. stocks plunged by 40 percentage points in one month, flipping from a net overweight in February to a net 23% underweight in March. This biggest ever drop in allocation to U.S. stocksreflects a dramatic collapse in confidence. Managers haven’t been this underweight U.S. equities since mid-2023, essentially marking a total capitulation on the “U.S. exceptionalism” narrative that had dominated for years. BofA’s strategists noted that investors were spooked by concerns of stagflation and a global trade war, prompting a so-called “bull crash” in sentiment where even a bull market can crash in enthusiasm. Rather than rotate into other risky assets, fund managers largely moved to cash – cash allocations jumped to their highest since the 2020 pandemic shock. In other words, big money is selling U.S. stocks at record speed, raising cash or redeploying to regions like Europe.

At Historic Extremes: U.S. Underweight at Levels Last Seen in 2005

Global fund manager positioning in U.S. equities nears historic bearish extremes. March 2025’s underweight (UW) reading rivals the lows of early 2023 and 2005, when U.S. stocks were deeply out of favor.

This sea-change in allocation has pushed sentiment to an extreme rarely witnessed in the past two decades. The March 2025 survey’s net 23% underweight in U.S. equities puts it in the same ballpark as previous nadirs of U.S. stock sentiment. For context, the last time fund managers were so negative on U.S. stocks was in early 2023, amid recession fears following 2022’s bear market. In January 2023, a net 39% of managers were underweight U.S. equities – the most bearish positioning since October 2005. (Back in late 2005, investors had similarly shunned U.S. stocks in favor of international markets.) The fact that today’s readings are comparable to those extreme lows underscores just how profound the current rotation is. Global equity allocation overall has also dropped sharply – to just a net 6% overweight (the lowest since late 2023) – as fund managers trim exposure to stocks and boost cash. Such extreme positioning can eventually set the stage for a rebound, but for now it’s a sign of just how decisively sentiment has swung against U.S. markets in favor of overseas opportunities.

What’s Driving the Shift? Key Catalysts Behind the U.S.-to-Europe Rotation

Why are investors abruptly favoring Europe over the U.S. in early 2025? Several macroeconomic and geopolitical catalysts have aligned to spark this rotation:

- Monetary Policy Divergence: Central bank paths have flipped from the 2022–2023 script. The Federal Reserve has paused its rate hikes and only cautiously hinted at potential cuts later in 2025, given lingering U.S. inflation and economic uncertainty. In contrast, the European Central Bank has already begun easing. In March 2025 the ECB cut interest rates by 25 basis points, continuing a cycle of rate reductions as eurozone inflation cooled. This policy divergence – Fed on hold while ECB loosens – has weakened the U.S. dollar and boosted European asset values. The euro jumped to a four-month high (~$1.07) as traders unwound bets on U.S. rate superiority. A softer dollar makes European stocks relatively more attractive (and U.S. stocks less so) to global investors.

- Growth vs. Recession Outlook: Economic momentum favors Europe, while the U.S. faces growing recession risk. Late 2024 data showed the eurozone surprising to the upside – Q4 GDP growth hit 0.9% year-on-year, the fastest since early 2023, aided by falling energy prices and resilient consumer demand. Major European economies like Spain saw robust growth (+3.5% in 2024). Meanwhile, U.S. indicators have softened in early 2025. The U.S. is grappling with an escalating trade war (as the new administration’s tariffs take a toll on business confidence) and the lagged effect of past Fed hikes. Investors are increasingly wary that the U.S. could tip into stagflation or a mild recession, whereas Europe’s outlook has brightened. One vivid illustration: bank stocks – in the past month, a U.S. banks index sank 8% while Europe’s bank index jumped 15%, reflecting stronger confidence in Europe’s cycle. As U.S. growth expectations waver, global investors are reallocating toward regions with more upbeat prospects.

- Valuations and Earnings: Going into 2025, European equities were significantly cheaper than U.S. equities – and now investors are taking notice. The valuation gap has been extreme: the S&P 500’s forward price/earnings ratio was in the high 20s, while Europe’s STOXX 600 traded closer to mid-teens P/Es. Such a discount, coupled with Europe’s more value-oriented sectors (banks, industrials, materials), set the stage for outperformance once catalysts emerged. Indeed, value and dividend stocks – areas where Europe is rich – have led the rally. European corporate earnings are expected to rebound in 2025 (after near-zero growth in 2024). And although U.S. earnings growth is forecast to be higher in 2025, investors appear to be betting that much of the U.S. earnings recovery was already priced in after the big 2023 rebound, whereas Europe’s upside was underestimated. In simple terms, Europe offered a “cheap” play on global recovery, and now that bet is paying off.

- Geopolitics and Policy Regime Change: The political backdrop has made U.S. markets less predictable and Europe relatively stable. Since taking office in January, President Trump’s administration has ripped up the playbook on trade and foreign policy, launching aggressive tariffs that sparked a global trade war. This has unnerved investors who for years believed in “U.S. exceptionalism” – the idea that the U.S. economy and markets would outshine the rest Now, that confidence is cracking, with 69% of fund managers saying the era of U.S. exceptionalism has peaked. At the same time, Europe is benefiting from newfound unity and investment. Germany, for example, announced a historic fiscal expansion (the biggest overhaul of fiscal policy since reunification) to stimulate its economy. European defense spending is rising (“rearmament”), and China’s reopening is boosting European exporters. Collectively these trends make Europe a more compelling story in 2025. The more confrontational and uncertain U.S. political climate – with a volatile lead-up to the next election cycle – further tilts some capital toward the steadier outlook in Europe. Even currency dynamics reinforce this: as noted, a weaker dollar (on Fed-versus-ECB policy divergence) makes international diversification attractive, and fund managers have correspondingly cut bullish dollar positions in half.

- Investor Behavior and Sentiment Shifts: It’s worth noting that not everyone caught this rotation immediately. Retail investors in the U.S. initially kept buying the dip, even as institutions rotated out. In fact, between January and March, retail traders bought more than $2 billion of U.S. stocks on 16 separate days – an unusually aggressive pace of dip-buying (that level of daily buying happened only 4 times in the prior two years). This provided temporary support to U.S. markets in early 2025, but ultimately those dips “kept dipping” as the broader trend remained weak. The enthusiasm of retail traders for fallen tech giants was not enough to stem the outflow of institutional capital. Now, with U.S. stocks underperforming, we may finally see more retail and advisor money follow the rotation into international and European funds. Sentiment can become self-reinforcing: U.S. equities recently saw the most bearish investor attitude since 2005, while Europe is enjoying its moment as the contrarian favorite.

How Long Can This Rotation Last? Outlook and Investor Implications

The big question for investors is whether this pro-Europe, anti-U.S. trend is a short-term reaction or the start of a longer-term regime shift. While it’s impossible to know for sure, we can consider a few signposts:

On one hand, many of the tailwinds favoring Europe could persist. Monetary policy in Europe is likely to stay accommodative relative to the U.S. for the near future – the ECB may continue cutting rates through 2025, whereas the Fed is cautious about easing too fast. If U.S. inflation remains sticky and the Fed holds rates higher for longer, that policy divergence and resultant dollar weakness may keep boosting European assets. Likewise, if the U.S. economy stagnates under the weight of trade tariffs and past rate hikes, while Europe’s economy surprises on the upside (helped by fiscal stimulus and export growth), investors could keep reallocating to European equities for growth exposure. Valuations still favor Europe as well; even after this rally, Europe’s equity indices trade at a valuation discount to the U.S. If earnings in sectors like European financials and industrials continue to rebound, there may be further room for Europe to run. In short, the rotation could have legs if the factors that launched it – cheaper prices, improving fundamentals, and a calmer inflation/policy backdrop – continue. Some analysts even argue that we are seeing a “tectonic shift” away from U.S. assets that could endure as global portfolios normalize after years of U.S. overweights.

On the other hand, history urges caution in assuming Europe will keep outperforming indefinitely. Over the past few decades, periods where Europe outshines the U.S. have typically been short-lived. Structural challenges in Europe – such as lower long-term growth, an aging population, and lower tech sector investment – haven’t gone away. Indeed, even in 2025, the consensus is that U.S. corporate earnings growth (helped by tech and innovation) will outpace Europe’s by year-end. Political risks could also swing the pendulum. If progress is made on U.S.-China trade negotiations or the tariff war de-escalates, it could remove a dark cloud hanging over U.S. stocks. Likewise, as the U.S. enters the later half of the presidential term, investors might start anticipating a more market-friendly policy environment (for example, if the rhetoric softens ahead of the 2026 midterms or 2028 election). Fed policy is another wildcard: should U.S. inflation cool more rapidly than expected, the Fed might cut rates sooner, jolting U.S. markets back to life and perhaps strengthening the dollar – developments that could slow the flow of funds to Europe. In fact, the extreme bearish positioning on U.S. equities itself could set the stage for a reversal. If everyone who wanted to reduce U.S. exposure has already done so, even slightly good news could spark a snap-back rally in U.S. stocks. Fund managers in the BofA survey noted that an end to trade war fears could allow the S&P 500 to climb back above 6,000, whereas a severe U.S. recession (one risk case) might send it below 5,000. In other words, the range of outcomes is wide, and much will depend on how economic and political events unfold in coming months.

For investors, the current rotation is a reminder of the importance of global diversification. Those who tilted heavily toward U.S. megacap stocks in recent years have felt some pain in 2025, while portfolios with international exposure have been rewarded. The big shift of capital to Europe suggests that opportunities exist beyond the U.S. borders, especially in sectors and regions that were out of favor. However, one should also be mindful that today’s leaders can become tomorrow’s laggards. After such a sharp move, it’s wise to monitor the same factors we discussed – central bank policies, growth trends, currency moves, and geopolitical developments – for signs that momentum is shifting again.

DeepCap AI in Final Testing Phase for EU equities

Meanwhile, our DeepCap team has been hard at work testing and refining our AI models on EU stock market data from the past 30 years. We’re aiming to achieve the same consistent market-beating performance that our main AI model achieves for US stocks. There are large differences in how investors in EU (both institutional and retail) behave for EU stocks, as compared to the more speculative and historically trend-leading nature of US stocks. But we are coming close to finding the right mix in beating EU stock indices.

Conclusion

The early-2025 rotation from U.S. to European equities has been significant and rapid, driven by a confluence of macro forces and a reversal in sentiment. Europe has finally taken the spotlight with strong returns and inflows, while U.S. stocks have stumbled under policy and growth clouds. Whether this marks a lasting changing of the guard or just a transient rebalancing, it has important implications. Investors should stay nimble and informed: today’s market landscape underscores how quickly capital can rotate when the narrative changes. By keeping an eye on inflation trends, monetary policy updates, and political signals on both sides of the Atlantic, you’ll be better positioned to navigate whatever comes next – be it an extended European renaissance or a U.S. comeback. In a world of rotations, the best strategy is to stay diversified, vigilant, and ready to adjust course as new data emerges. After all, the only constant in global markets is change – and 2025’s great capital rotation is a prime example of that in action.