U.S. Markets: Wall Street Whiplash – Relief Rally, Rough Week

It was a roller-coaster week on Wall Street. Even with a big relief rally on Friday, all three major U.S. indexes still finished the week deep in the red – each down over 2% – with the Dow logging its worst weekly drop since 2023. The S&P 500 and Nasdaq Composite have now fallen for four straight weeks, officially pushing the S&P into correction territory (over 10% off its peak) alongside the Nasdaq. Tech and other growth stocks bore the brunt of the selling, though they staged a sharp rebound to end the week. Dip-buyers finally stepped in after some encouraging inflation data, giving the S&P 500 and Nasdaq their biggest one-day jump since last November.

What drove this wild ride? In a word: tariffs. Escalating trade-war headlines from Washington kept investors on edge. Mid-week, stocks plunged after a fresh tariff crossfire with Europe – the EU slapped hefty duties on U.S. whiskey, prompting President Trump to threaten “a 200% tariff” on European wine and spirits. Fears that this tit-for-tat trade war could fan inflation and tip the economy into recession soured market sentiment. As one trader put it, “Sentiment’s terrible… new tariff headlines every day” – especially hitting big tech names that had been propping up the market. By Friday, however, hopes that inflation might be cooling (more on that below) helped spark a relief rally, though it wasn’t enough to erase the week’s losses. Wall Street’s volatility is back: the market’s “fear index” (VIX) nearly doubled over the past month amid the tariff chaos, reminding investors that risk is running high in this headline-driven environment.

European Markets: STOXX Shaken, Then Stirred by German Stimulus

Across the Atlantic, European equities also felt the sting of trade tensions. The pan-European STOXX 600 fell for a second straight week, as Trump’s tariff flip-flops amplified slowdown fears across the region. By Friday, the STOXX 600 had notched an overall weekly loss, with autos and industrials under pressure from the U.S.–China and U.S.–EU trade crossfire. In fact, Europe has been caught in the tariff crosshairs – extreme “attack-and-retaliate” trade policies have been the epicenter of recent market volatility globally.

But Europe got a late-week boost from an unlikely source: Germany’s pivot to fiscal stimulus. In a historic move, Germany’s leading parties agreed to loosen the nation’s strict debt brake and unlock a €500 billion infrastructure and defense investment fund. This prospect of extra government spending to revive growth in Europe’s largest economy sent German stocks surging – the DAX jumped ~1.9% Friday and is up ~15% year-to-date on hopes of these sweeping reforms. The news lifted broader European markets too. The STOXX 600 rallied 1.1% on Friday after Germany’s deal was announced, and it extended those gains modestly on Monday, up about 0.3% by mid-morning. In other words, Europe’s mood swung from trade-war jitters to cautious optimism, as Berlin’s budget U-turn hinted at a growth backstop. Still, investors remain wary – the volatility under the surface suggests Europe isn’t out of the woods as long as transatlantic tariff tensions simmer.

Rates & Inflation: Fed on Hold as Price Pressures Ease (For Now)

Amid the market mayhem, there’s a silver lining on the macro front: inflation appears to be cooling, giving central banks a bit of breathing room. In the U.S., consumer prices rose just 0.2% in February, the smallest monthly increase since last autumn. That put year-over-year CPI inflation at 2.8%, down from 3.0% in January. Core inflation was similarly tame at +0.2% on the month. Producer prices echoed the trend – the PPI was flat (0.0%) in February, a much cooler reading than expected. Taken together, these two tame inflation reports mid-week were a welcome surprise and suggest price pressures had eased heading into March. “No factory inflation and no worrisome job layoffs either,” one economist noted, pointing out there’s “nothing to slow the economy’s advance for now”. In fact, the cooling prices helped reinforce expectations that the Federal Reserve can pause on rate changes for the moment.

However, that inflation relief may be only temporary. Notably, those February figures don’t yet reflect the latest tariffs rolling through supply chains – and economists warn that the trade war could soon push prices higher. The Labor Department itself noted the CPI data “did not fully capture” the cascade of new import tariffs, which have already boosted consumers’ inflation expectations and led analysts to bump up their future inflation forecasts. In fact, surveys show U.S. households suddenly bracing for a spike in prices later this year, thanks in part to tariff-related cost pressures. Bond markets are sniffing this out too: Treasury yields perked up late last week after a report showed long-term inflation expectations jumping to multi-decade highs. The benchmark 10-year yield climbed to around 4.32% on Friday, even as investors flocked to safe-haven bonds earlier in the week. It’s a reminder that the Fed’s battle with inflation isn’t necessarily over – but for now, policymakers seem inclined to wait and see. The Fed meets this week, and it’s widely expected to keep interest rates unchanged at its current 4.25–4.50% range on Wednesday. Futures markets still predict a couple of rate cuts by year-end (roughly 0.75% of easing) as growth risks mount, but any hint of stickier inflation could upend those dovish bets. Central bankers on both sides of the pond are walking a tightrope: Europe’s ECB has noted that Trump’s trade policy is making their monetary decisions “more difficult,” creating an opaque mix of higher inflation and lower growth to juggle. Bottom line – interest rates likely stay on hold for now, yet the policy outlook remains at the mercy of incoming data and trade drama.

Futures & The Week Ahead: Cautious Start, Big Events on Deck

After last week’s turmoil, U.S. stock futures are signaling a cautious start to the new week. Early Monday, Dow, S&P 500, and Nasdaq futures each slipped about 0.4–0.5%. The slight dip came after U.S. Treasury Secretary Scott Bessent (a key economic official) poured a bit of cold water on the weekend: in a Sunday interview he warned there are “no guarantees” the U.S. will avoid a recession. Those sober comments added to the wall of worry facing investors, who are already fretting that the trade war and policy uncertainty could choke off growth. Indeed, President Trump’s hardline tariff stance – he’s refusing to grant exemptions on metals and has more sector-wide tariffs set to kick in April 2 – has many on Wall Street anxious about a potential trade-induced downturn. Little surprise, then, that futures are muted and the VIX volatility index remains elevated.

Still, the coming days offer a chance for clarity (or at least a few answers) as several major events unfold. Here are the key things to watch in the week ahead:

- Fed Rate Decision (Wed) – The Federal Reserve’s policy meeting will be front and center. The Fed is expected to hold rates steady, but investors will parse every word of Chair Jerome Powell’s comments for clues on future moves. Any shift in tone – say, acknowledging the tariff turmoil or tweaking inflation forecasts – could spark a market reaction. Keep an eye on the Fed’s new economic projections; officials may trim growth outlooks or raise inflation estimates in light of Trump’s trade policies.

- German Debt Vote – Germany’s parliament will vote on the landmark debt reform package that cleared a committee over the weekend. A final approval (expected in the Bundestag Tuesday and Bundesrat Friday) would cement the €500 billion spending plan, potentially giving European stocks another shot in the arm. Conversely, any political hiccup or delay in this stimulus plan could temper the euro zone rally. European markets will also watch the Bank of England on Thursday, though the BoE is likewise forecast to keep rates unchanged.

- Trade War Wildcards – U.S.–China trade developments and transatlantic tariff news remain wildcards. The White House’s next round of sector tariffs looms in two weeks, and the OECD just warned that Trump’s tariff hikes will sap growth and boost inflation across North America. Any softening or escalation in trade rhetoric (for example, if new negotiations emerge or if tariff threats intensify) could sway market mood instantly. Also worth noting: President Trump is slated to speak with Russia’s Vladimir Putin on Tuesday about geopolitical issues – not directly market-related, but any surprise outcomes (e.g. hints at easing sanctions or progress on conflicts) could ripple through oil and commodity markets.

- U.S. Economic Data – A batch of data will test the resilience of the U.S. consumer and housing sector. February retail sales (out Monday morning) is one to watch as a barometer of consumer spending amid all the uncertainty. Weak retail numbers could signal that high prices and policy jitters are finally curbing shoppers’ appetites. Also on tap: housing starts, industrial production, and weekly jobless claims. Thus far, the labor market has stayed solid (jobless claims remain low, but any cracks in these reports could reinforce slowdown worries – or, conversely, surprisingly strong data might soothe recession fears.

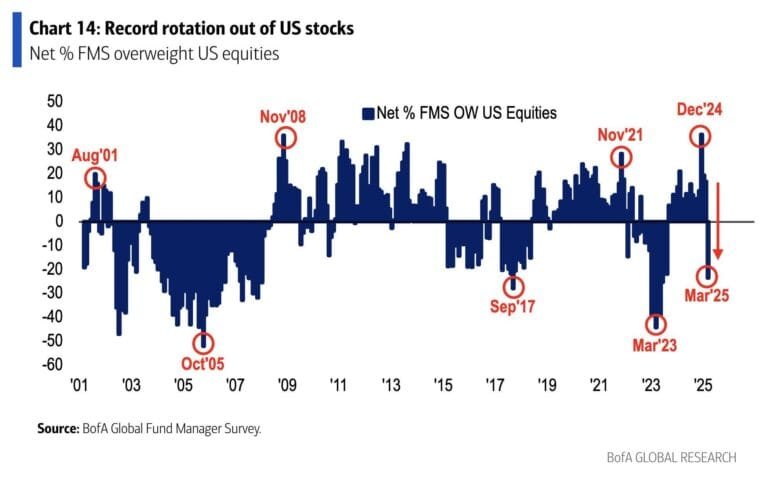

Overall, investors head into the week with a mix of trepidation and hope. Some big questions: Will cooler inflation and potential policy support (like Germany’s stimulus) be enough to counteract the drag from tariffs and rising recession angst? Will more investor capital be shifting from US to EU? Buckle up – the only certainty here is uncertainty.

Disclaimer: This commentary is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a financial advisor before making investment decisions.