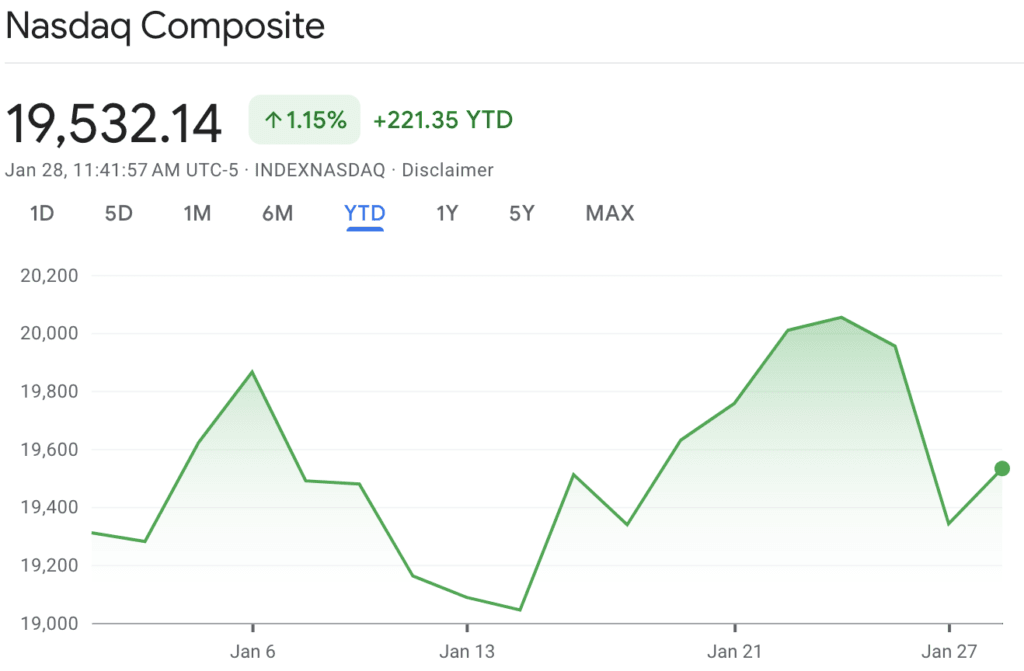

The U.S. stock market has kicked off 2025 with a whirlwind of activity, marked by sharp swings, political pivots, and tech turmoil. President Trump’s return to the White House has sparked fervent discussions over his policy moves, including promises to deregulate key industries, revamp trade policies, and fast-track AI investments. Yet, amidst the excitement, the rise of a disruptive player, Deepseek, has sent shockwaves across Wall Street, triggering a significant sell-off in tech, with Nvidia (NVDA) bearing the brunt.

Deepseek Disruption: The AI Shift That Spooked Tech

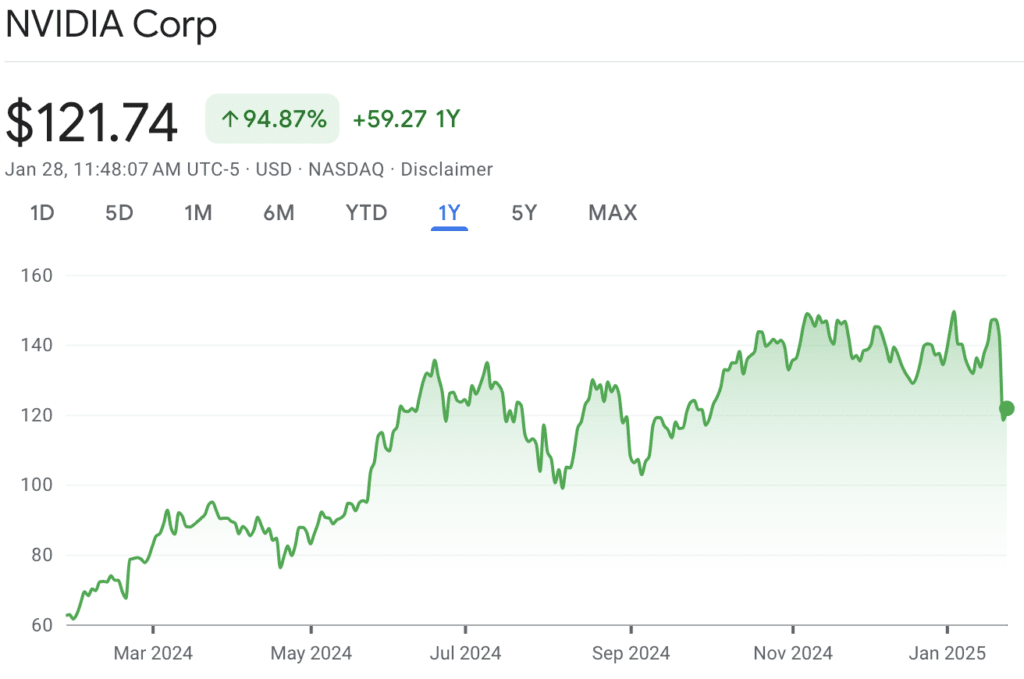

Deepseek, an innovative AI company specializing in autonomous systems and software solutions, has taken center stage. Its groundbreaking technology has attracted immense investor attention, sparking a rotation out of established tech giants. NVDA, a perennial market darling, has been particularly hard-hit, tumbling nearly 18% since the start of the year. Analysts attribute this sell-off to concerns over increased competition in the AI chip space and a broader reallocation of capital toward emerging players like Deepseek.

DeepCap’s AI-powered analysis still holds NVDA in high regard, highlighting its robust fundamentals and leadership in GPUs. However, the platform advises caution, noting the selling momentum from institutional players. This echoes DeepCap’s earlier guidance in 2024, urging partial profit-taking on NVDA amidst its meteoric rise.

A Market Rife With Contradictions

Trump’s pro-business policies have fueled optimism in traditional sectors like energy and manufacturing, while tech’s roller-coaster ride underscores the precariousness of high valuations. Deepseek’s rise is seen as emblematic of a broader shift toward next-generation technologies. Meanwhile, Amazon (AMZN), despite strong earnings last year, remains under pressure due to heightened spending on AI and cautious forward guidance.

DeepCap’s DeepList Stands Resilient

Amidst the turbulence, DeepCap’s DeepList has proven its mettle. Stocks like Shake Shack (SHAK), recently added for short-term plays, continue to perform despite broader market bearishness. This reinforces the platform’s strategy of blending growth opportunities with tactical positioning. Investors are reminded that short-term sell-offs often present buying opportunities for the stocks in DeepList, as long as prudent dollar-cost averaging is exercised and the having the right time-frame of being long-term focused.

Key Takeaway

As 2025 unfolds, the U.S. stock market offers a potent mix of opportunity and risk. Trump’s economic agenda, combined with the rapid ascent of companies like Deepseek, sets the stage for an eventful year. For DeepCap subscribers, the message is clear: Stay informed, stay strategic, stay cautious and above all, stay focused on the long term. The volatility of early 2025 is a reminder of both the pitfalls and promises of investing in a market driven by innovation and uncertainty.