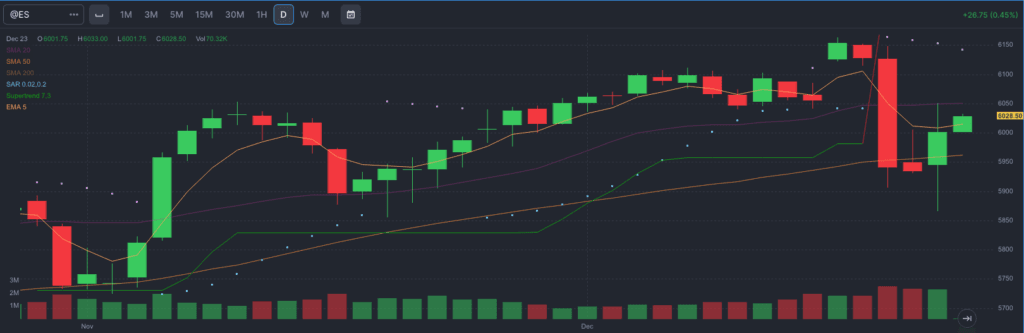

During the holiday season, Wall Street enters a peculiar time marked by the so-called “Santa Claus Rally.” This phenomenon, observed during the final week of December and the first two trading days of January, often brings a flurry of optimism and upward momentum in the markets. But if you’ve been paying attention, you’ll notice a recurring pattern: many investors and traders jump in early, only to start selling off before Christmas. What’s behind this behavior?

The Optimism of the Season

The Santa Claus Rally is driven by a mix of factors. Year-end portfolio rebalancing, holiday spending surges, and the festive cheer often translate into higher consumer confidence and market optimism. Institutional investors also tend to wrap up major trading decisions ahead of Christmas, leaving retail traders and algorithm-driven funds to push prices higher in the lighter trading environment.

Why the Early Buying?

Investors and traders often buy at the start of the Santa Claus Rally for several reasons:

- Positioning for Momentum: The rally is a self-fulfilling prophecy for many. Historical data shows that stock indices frequently post gains during this period. Traders aim to capitalize on this trend by entering positions ahead of time, hoping to ride the wave of upward momentum.

- Tax Considerations: Many traders seek to lock in gains early to offset losses for the year, ensuring tax efficiency. This prompts an early spike in buying activity before selling pressures set in.

- Quarter-End Window Dressing: Fund managers often buy high-performing stocks to showcase them in their year-end reports, further bolstering demand at the rally’s start.

The Pre-Christmas Sell-Off

Despite the initial buying frenzy, selling before Christmas is a strategic move for several reasons:

- Profit-Taking: Early buyers look to secure gains before year-end market volatility can erode profits. By selling before Christmas, they avoid the uncertainty that often accompanies the final days of the year.

- Thin Trading Volumes: As the holidays approach, market volumes typically dwindle, which can lead to increased volatility. Savvy traders prefer to exit before the potential for sharp, unpredictable moves arises.

- Shifting Focus to January Effect: Investors who sell before Christmas may already be positioning themselves for the “January Effect,” another seasonal trend where small-cap stocks tend to outperform in the first month of the year.

Timing Is Everything

The Santa Claus Rally remains one of the market’s quirkiest traditions, blending psychology, seasonality, and strategy. While some prefer to hold through the entirety of the rally, others strategically exit early, locking in profits and avoiding potential pitfalls. For retail investors, understanding this pattern can help navigate the holiday season’s market dynamics, whether you’re buying in for the rally or watching from the sidelines.

In the end, the real gift of the Santa Claus Rally lies in the lessons it offers: markets are as much about human behavior as they are about numbers. And knowing when to ride the sleigh—and when to jump off—can make all a large difference.

However, if you’re a DeepCap subscriber, you would know that in most situations with the stocks in our DeepList, it’s usually better to just sit in the sleigh and ride it out.