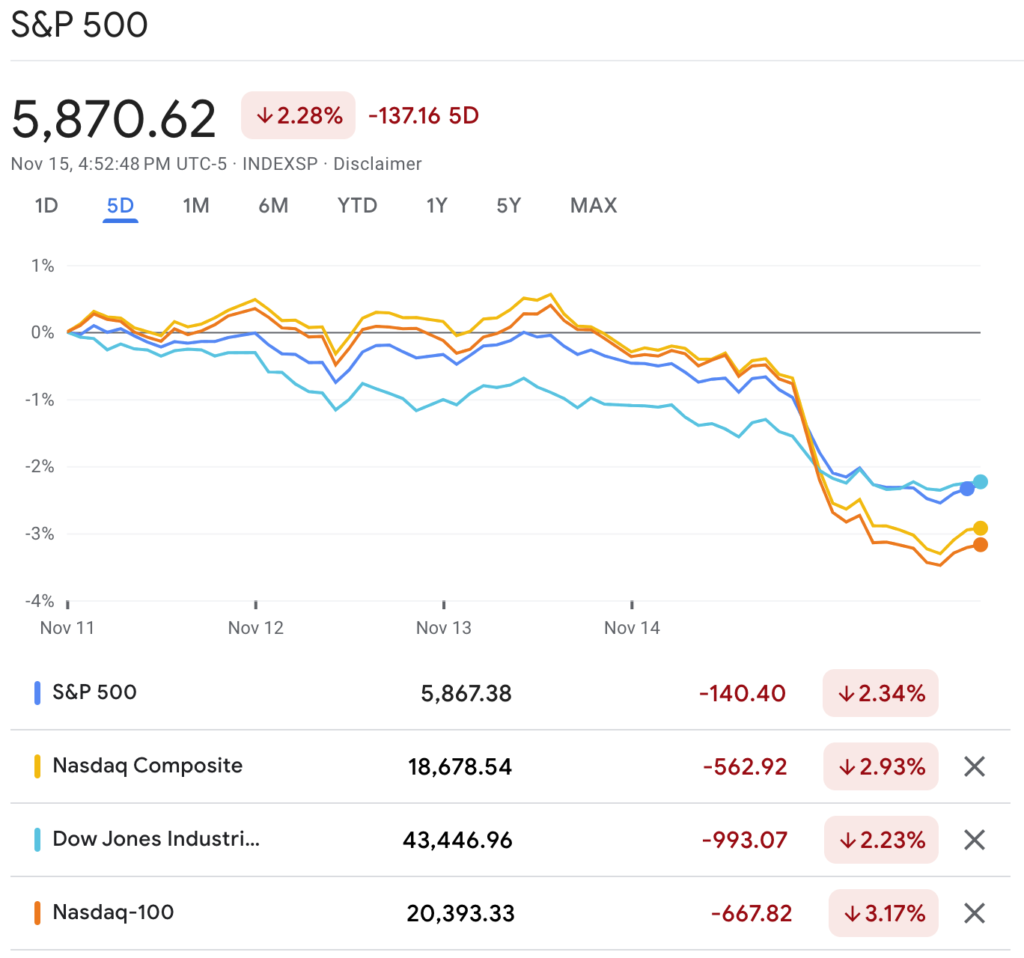

Market indices began the week with a mix of profit-taking and cautious gains, but quickly took a short dive down after the Federal Reserve Chair Jerome Powell indicated on Thursday November 14, that there were no immediate plans for further interest rate cuts.

Powell said that ongoing economic growth, a strong economy and inflation levels above the 2% target all signaled that there was no need to rush for further rate cuts. This cautious approach probably led investors to adjust their expectations, contributing to market declines.

After a prolonged rally post-Trump election, many tech stocks were trading at historically high valuations. Investors likely saw this as an opportunity to lock in profits. The Fed’s stance on maintaining rates accelerated price corrections.

Also of note is Bitcoin’s upward trajectory, surpassing $93,000 for the first time during the week, probably thanks in part to Elon Musk’s endorsement of the meme-cryptocurrency Dogecoin, as well as continued optimistic speculative trading.