On November 5, 2024, the U.S. presidential election concluded, with Donald Trump securing a decisive victory, marking his return to the White House. Investors responded almost immediately, spurred by expectations of pro-business policies such as tax cuts and deregulation, driving a powerful market rally across sectors.

Market Rally: Indices Reach New Heights

Regardless of what you think of Trump or US politics in general, one cannot deny the massive rally this event has brought about.

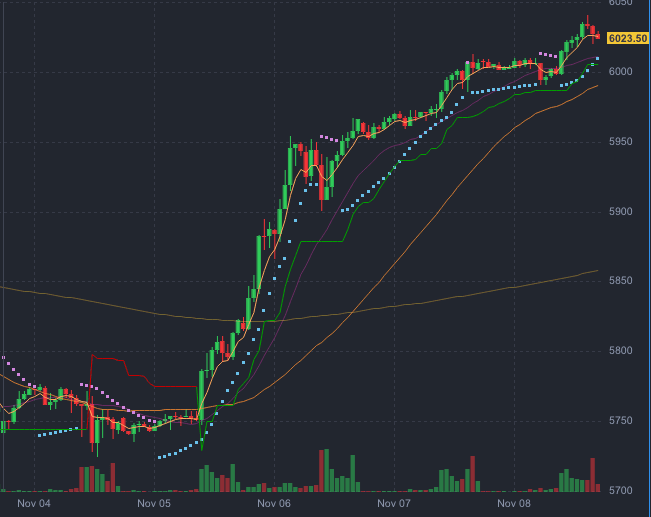

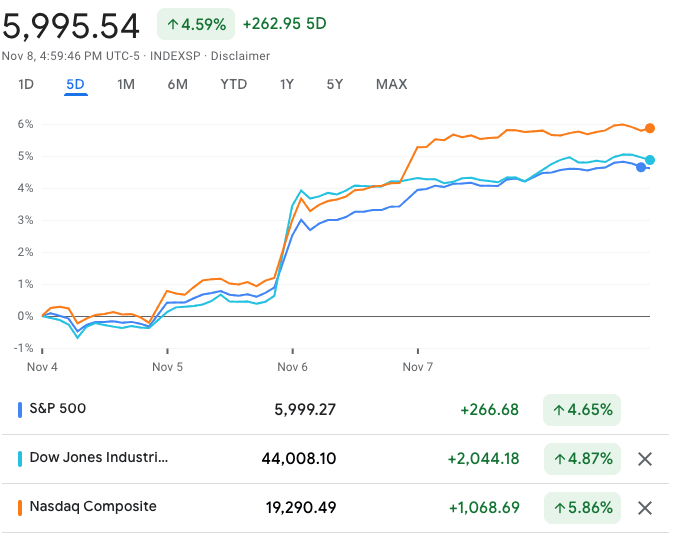

During the week of November 4 to 8, 2024, U.S. stock markets experienced significant gains:

- S&P 500 Index: Increased by approximately 4.65%, closing at a fresh all-time high.

- Dow Jones Industrial Average: Advanced by about 4.87%, surpassing the 44,000 mark for the first time.

- Nasdaq Composite: Rose by around 5.86%, driven by strong performances in the technology sector.

U.S. Dollar Strengthens

Following the election, the U.S. dollar appreciated against major currencies. This rise was attributed to investor optimism about the incoming administration’s economic policies, which were expected to stimulate growth and potentially lead to higher interest rates. The dollar’s strength was evident in its performance against currencies like the euro and yen.

Deregulation Under Trump: Market Impact

A Trump-led push for deregulation could have notable effects across sectors:

- Financial Sector: A lighter regulatory environment would be a boon for banks, investment firms, and insurers. Policies targeting a rollback of Dodd-Frank provisions and reduced oversight could drive up financial stocks, as compliance costs decline and lending restrictions ease. This could stimulate more capital flow into the economy, potentially benefiting everything from consumer lending to corporate financing. Contrarians might argue that this is the start of a giant inflationary bubble.

- Energy and Industrials: Trump’s anticipated deregulation in the energy sector, particularly around fossil fuels, would likely lift oil and gas stocks. Eased environmental regulations could reduce costs for producers, and policies incentivizing domestic energy might bolster U.S. oil, gas, and coal production. Industrials, too, could see gains as infrastructure and manufacturing projects become more attractive under streamlined regulatory requirements.

- Healthcare and Pharmaceuticals: A pro-deregulation stance could favor pharmaceutical companies, as regulatory burdens on drug approvals might be loosened. However, any policy changes in healthcare funding or insurance mandates would need to be monitored, as they could have mixed effects on different healthcare sub-sectors.

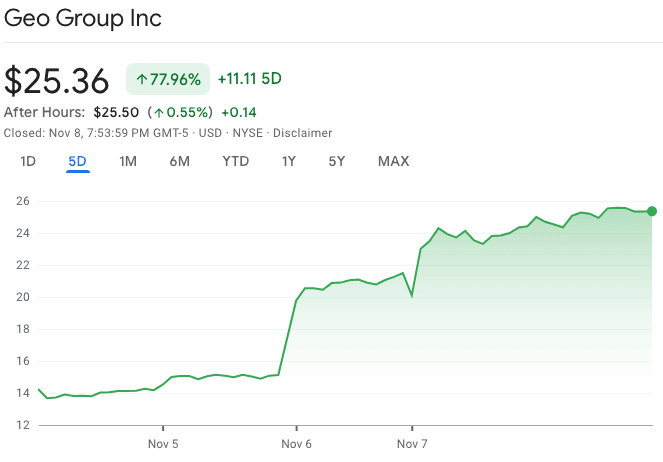

Sector Spotlight: Private Prisons Surge on Policy Expectations

On November 8, 2024, private prison stocks surged amid speculation of favorable policies:

- CoreCivic Inc (CXW): Up 70.61% for the week.

- The GEO Group, Inc. (GEO): Jumped by 77.96% for the week.

Promises made by Trump to carry out mass deportation and crackdowns on undocumented immigrants and foreigners, coupled with expectations of expanded private prison contracts and relaxed regulatory oversight – all of this have driven substantial investor interest in this sector. If you didn’t know that private prisons existed before, you can read more about them in this Wikipedia entry.

Federal Reserve: A Preemptive Rate Cut to Fuel Growth

The Federal Reserve cut the federal funds rate by 25 basis points to 4.50%–4.75% on November 6, 2024, signaling a supportive stance for growth amid Trump’s anticipated fiscal policies. The rate cut aligns with expectations for government-driven spending but highlights the Fed’s caution around potential inflationary pressures.

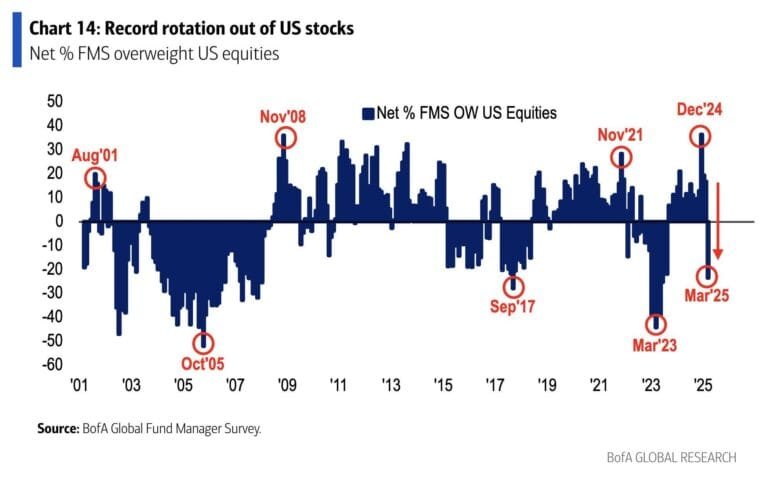

Looking Ahead: Navigating a Transforming Market

Brave New World, Resurgent Bull Market, Late-stage capitalism, the Rise before the Fall – whatever you call it, this certainly marks a new era for the US stock market. Trump’s economic policies could reshape market dynamics and the market is responding rapidly in anticipation of these upcoming changes. Investors should monitor policy announcements closely, as deregulation and higher tariffs will likely bring sector-specific opportunities and risks. A pro-deregulation stance may favor financials, energy, and manufacturing, while tariffs and trade shifts could weigh on sectors reliant on foreign production.

For DeepCap members, we will dive into what all this means for our DeepList and how we can navigate this new reality in our next post.