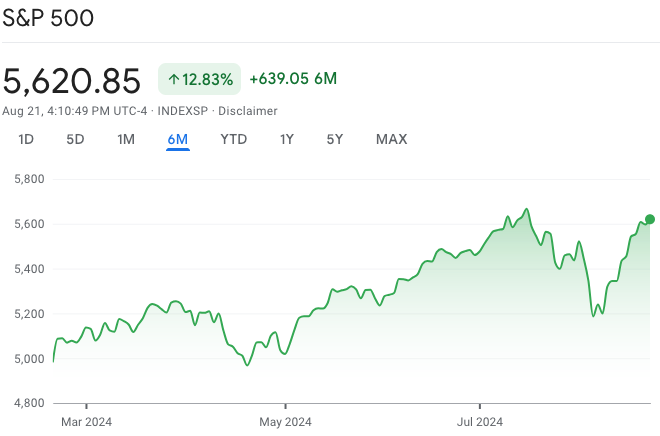

Our newsletter for members on 9 Aug showed that the market had already recovered about halfway through the drop it did from 31 Jul to 5 Aug. Just four trading sessions later, on 15 Aug, the market had already fully recovered from the drop. Today it’s approaching the highest point it achieved this year (on 16 Jul), just shy of 0.8% more to reach.

Before deciding whether it might be sensible to book some profits now, consider and weigh the three possible scenarios the market might take within the next month:

- Rise even further and create new 52-week highs. If you sell some of your portfolio now to book profits, you might be missing out on these new highs.

- Drop back down as the number of investors having the same idea as the previous scenario to sell and take profits outnumber buyers. Or worse, some other global or macroeconomic event shakes the market. Then it’ll be a sharp drop or even gap down.

- Similar to Scenario 2, the market might be stuck in a range for a month or two, due to substantial uncertainties (war and conflict, US politics, US unemployment number revisions, Fed decision on interest rates vs. Bank of Japan).

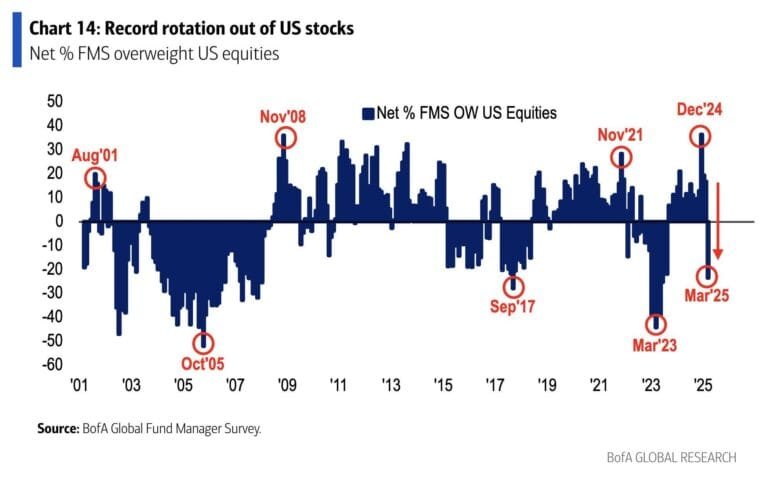

Few people truly believe in this market rally (a telling sign is in the trading volumes), and the economic situation on a global scale isn’t booming. Our extensive data that our AI engine analyzes all point towards a negative outlook. Take for example, the continued rise in gold hitting another record high of US$2520/ounce.

Silver, Platinum, copper and Palladium have all risen in tandem with the market as well.

Consider the VIX, or Volatility Index as well. It shot to a record high on 5 Aug, but has now come back down. It is still slightly elevated above its usual nominal range, showing that the market is not exactly confident about future direction.

In summary, it might be prudent to tread very carefully in the next two weeks. Doing nothing and just holding on might also be a sensible strategy, as trying to predict the market’s direction in the short term has been proven to be counter-productive and increases the probability of realizing losses.