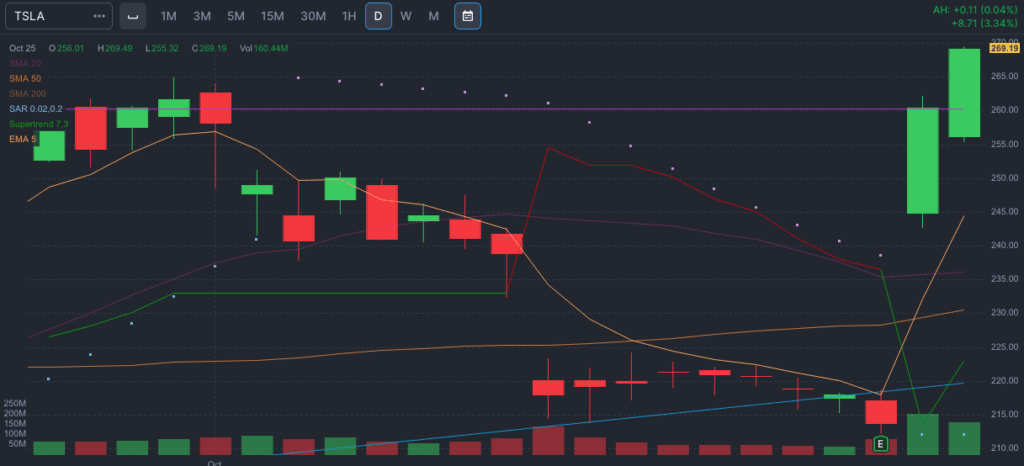

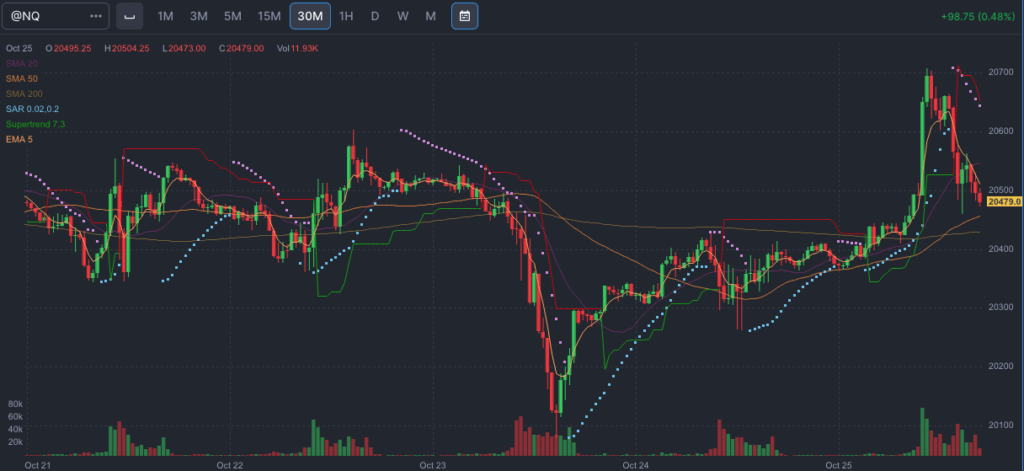

This week (October 21-25) saw significant volatility, with a standout performance from Tesla (TSLA) following its Q3 earnings report. Tesla’s stock soared nearly 20% on Thursday, marking its best day since 2013, driven by unexpectedly strong gross profit margins and an impressive jump in its energy storage business. Elon Musk’s forward-looking statements, including plans for a new affordable EV model by 2025 and the expansion of the energy division, reassured investors despite a slight revenue miss. These factors lifted Tesla’s stock to its highest close since September 2023, and the rally continued with a more modest 3% gain on Friday as the tech-heavy Nasdaq closed at a 3-month high.

Alongside Tesla, the “Magnificent Seven” tech stocks, which include other giants like Apple, Microsoft, and NVIDIA, posted gains, pushing the Nasdaq to an all-time high earlier in the week. This rally has helped buoy the broader market, with investors showing resilience despite continued concerns over rising bond yields and inflation pressures.

Tesla’s stellar performance and other tech gains this week reflect a renewed focus on growth sectors, as Wall Street closely watches for earnings reports to gauge how corporate America is handling economic challenges. This has led to a mixed sentiment, with some funds, such as Cathie Wood’s ARK ETFs, trimming positions in Tesla to capitalize on the surge while maintaining caution around high valuations.

Overall, the week underscored the strength of tech stocks in driving market optimism, even as sectors sensitive to interest rates and inflation remain more muted. Tesla’s rally has set a bullish tone heading into the next earnings reports, making it a focal point in discussions on tech resilience and growth potential in a challenging macroeconomic environment.