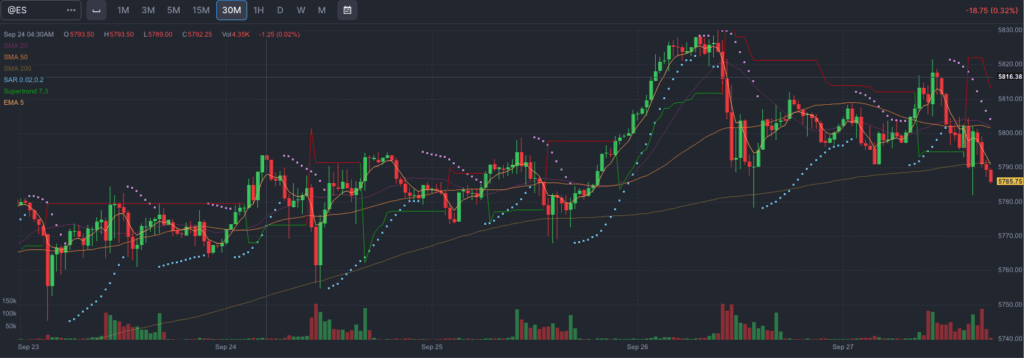

The U.S. stock market saw a dynamic week from September 23-27, 2024, with the S&P 500 hitting a 52-week high mid-week, fueled by investor optimism surrounding the Federal Reserve’s recent rate cut. However, the enthusiasm was tempered as the week progressed, with some sectors showing weakness amid broader economic concerns. Effectively, we’re quite close back to where we started last Monday.

The Federal Reserve’s 50-basis-point rate cut from the previous week continued to reverberate through the market. Initially, the reduction in borrowing costs provided a boost to equity prices, particularly in sectors sensitive to interest rates, such as technology and consumer discretionary stocks. However, as the week wore on, investor sentiment became more cautious as concerns about slowing economic growth began to resurface.

Tech stocks led the early gains, buoyed by renewed interest in AI and semiconductor industries. Nvidia and Apple saw rebounds, partially recovering from prior declines, while the broader tech sector benefited from expectations that lower interest rates would spur investment in innovation.

Meanwhile, ExxonMobil posted a strong performance, posting a 2.68% gain for the week. The energy giant benefited from slightly higher oil prices, despite broader stabilization in the sector. Geopolitical tensions and supply constraints remain key factors supporting energy stocks.

Meanwhile, consumer stocks posted mixed results. While companies like Shake Shack continued to ride high on consumer demand, others faced pressures from rising input costs and concerns over consumer spending heading into the holiday season.

The market also saw an uptick in volatility as industrial production data showed signs of weakening, contributing to fears that corporate earnings might falter in the coming quarters. By the end of the week, the initial enthusiasm from the Fed’s rate cut had moderated, with investors reassessing the economic landscape and preparing for more potential market swings.