Let's Shape The Future Of Your Investments!

Beat the market with DeepCap's stock picks and investment strategies.

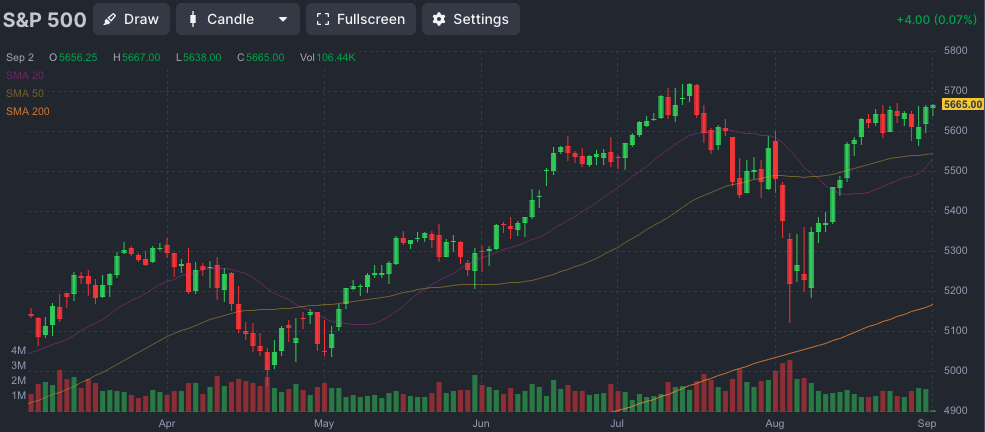

July’s employment data released back in early August triggered a market sell-off. So the market will probably be closely watching this Friday’s report on jobs growth and unemployment rate for August.

Or at least that is what most media outlets are reporting. Does past data like this actually influences the market to trade up or down? Doesn’t the market trade on future expectations of profitability? Regardless of which, this Friday’s event is certainly going to increase volatility.

Besides the Jobs Report, here are 4 other things to consider:

We would wait till next week before taking any directional action, but booking in some profits now would not be a bad idea.