DeepCap Performance

DeepCap consistently outperforms market indices: Insights and Updates

DeepCap Performance

A snapshot of DeepCap One, our equal-weight portfolio built from DeepCap AI’s stock picks (our DeepLists) and vetted by our analysts.

Snapshot

As of Oct 7, 2025 (UTC+3) · Currency: EUR

Figures shown are from DeepCap’s tracking portfolio; fees, taxes, and slippage are not included.

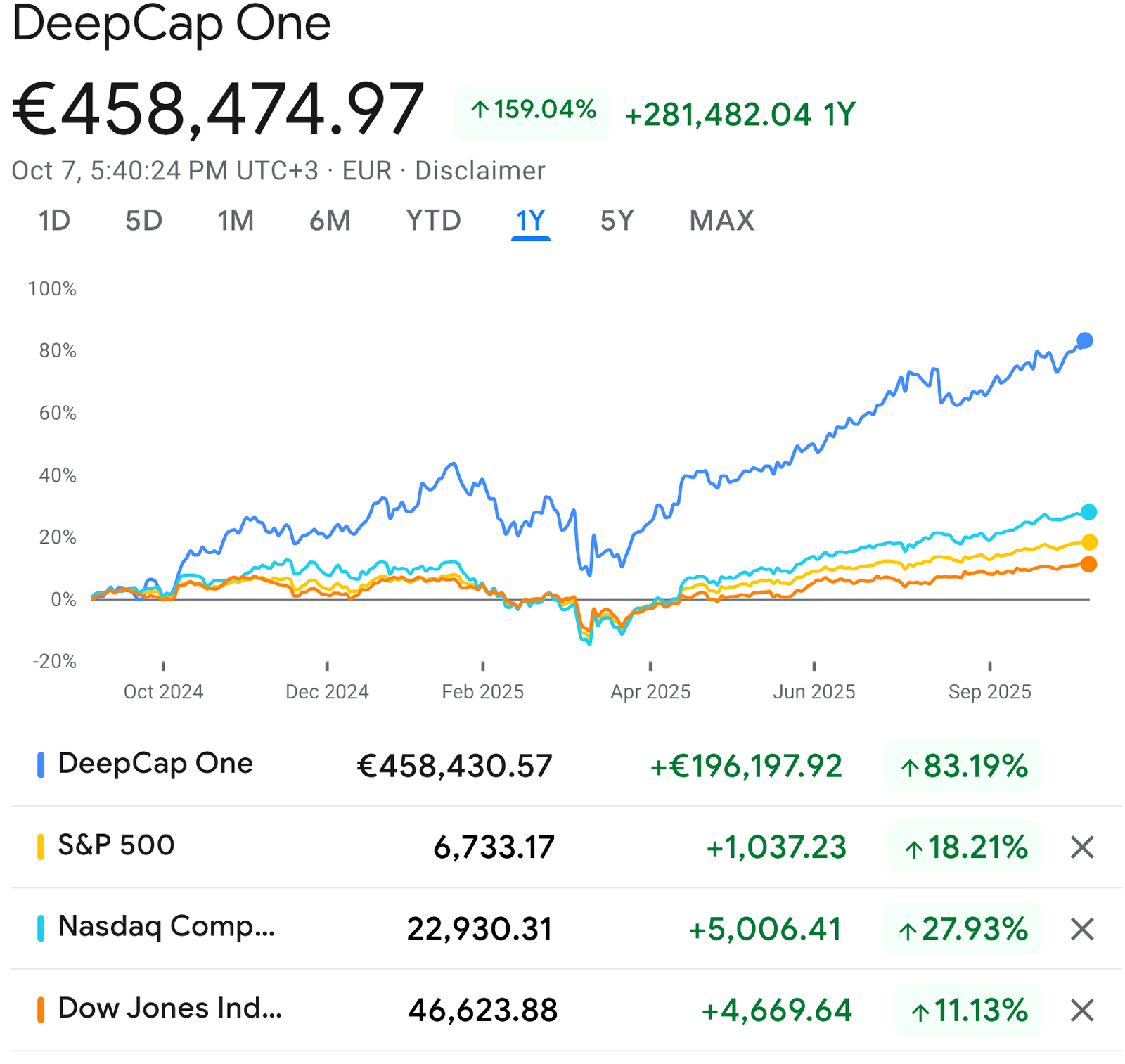

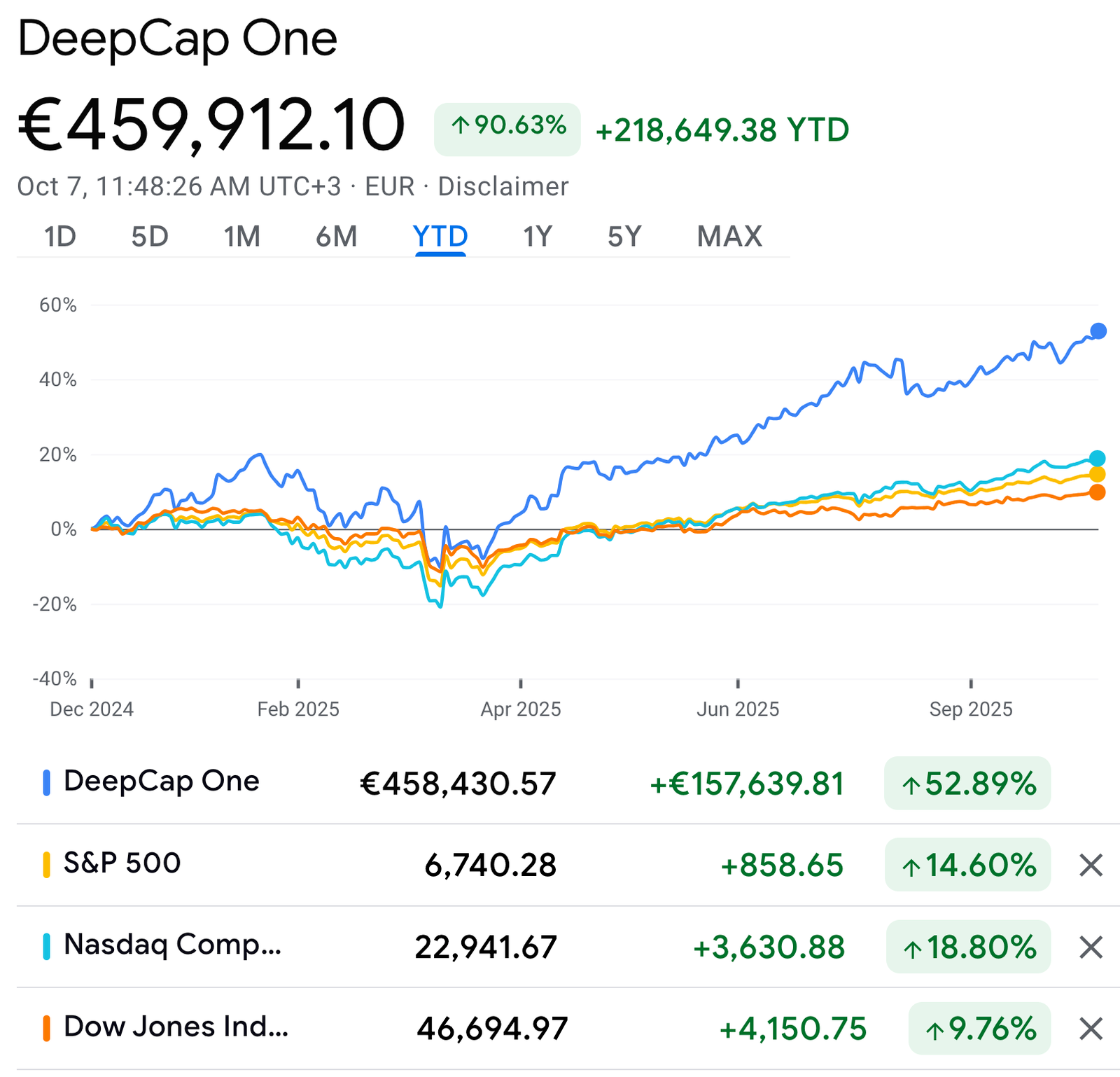

Year-to-Date vs Benchmarks

DeepCap One has outpaced the major indices YTD.

| Portfolio / Index | Level | YTD Change (€ / pts) | YTD % |

|---|---|---|---|

| DeepCap One | €458,430.57 | +€157,639.81 | +52.89% |

| S&P 500 | 6,740.28 | +858.65 | +14.60% |

| Nasdaq Composite | 22,941.67 | +3,630.88 | +18.80% |

| Dow Jones Industrial Avg | 46,694.97 | +4,150.75 | +9.76% |

Snapshot values taken from the same capture used for the chart above. For live numbers, please refer to the dashboard.

How DeepCap One is built

A systematic, risk-aware process that blends AI with human oversight.

- Quality data acquisition — multi-source fundamentals, prices, and events.

- Cleaning & filtering — survivorship-bias control, corporate-action handling, outlier checks.

- Model probabilities — machine learning across two horizons (6M momentum, 12M trend) plus technical confirmation.

- DeepLists curation — 6M, 12M, and a High-Conviction overlap list.

- Analyst vetting — experienced financial analysts review edge cases and catalysts.

- Equal-weight portfolio — 10–20 names; scheduled refresh; benchmark-aware reporting.

Subscribers see the names, weightings, refresh dates, and receive alerts ahead of significant events or list changes.

Members also receive alerts, analysis, and event triggers.