Our top-ranked stock picks beat the S&P 500 in 2025 by 37%

26.2%*

Articles & News

Only public posts can be seen here. Our subscribers get access to more valuable insights, analysis and stock picking updates.

-

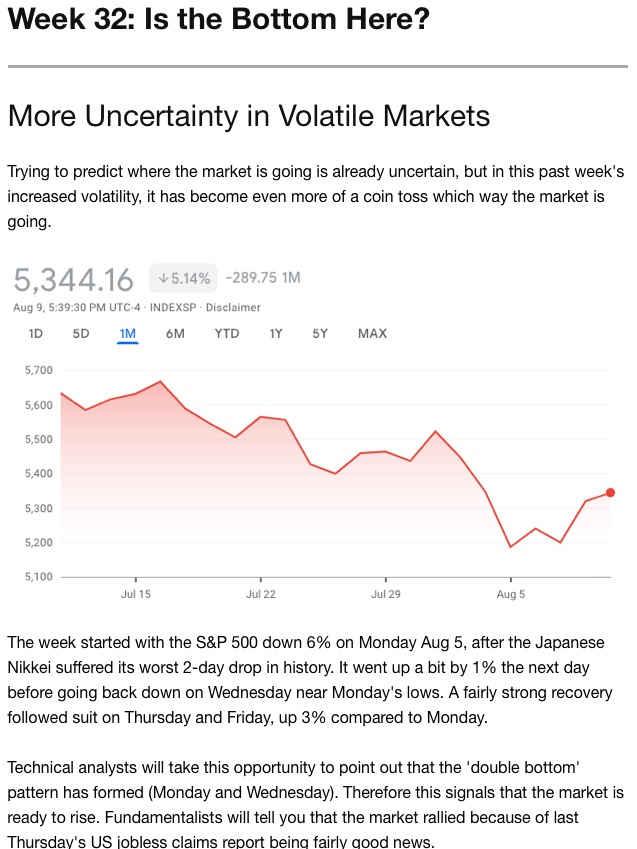

DeepCap Week Ahead Outlook

Japan market stress and yen intervention risk drive global rates sensitivity this week

Why Choose DeepCap

Better Than Market

Unlike managed funds and stock analysts, DeepCap AI doesn’t estimate a certain percentage return. What it can do is give you a consistent edge with the highest probability of outperforming better than market indices – something 93% of fund managers fail to do.

Supermix of Indicators

We constantly feed to DeepCap’s AI 82 fundamental, technical, social media, financial journals, and analysts’ indicators of the US stock market, using data from as recent

to a minute ago to 30 years ago.

500+ million combinations

We classify and rank our supermix of indicators, using over 500 million combinations to find the stocks that have the best chance of outperforming market averages and indices, and then picking the very top 1% of the top 10% of stocks.

Constant Monitoring

Our stock picks are checked daily, adjusting for changing market conditions. DeepCap AI may signal to sell if a stock no longer meets criteria, or identify new opportunities when a stock suddenly fulfills all conditions.

What DeepCap Members Get

Dashboard

The Dashboard is the first thing you’ll see when you log in as a subscriber. It provides everything you need in one single page to stay ahead of market movements: real-time news and updates, keeping you informed on the latest stock picks, AI-generated insights, and key market events.

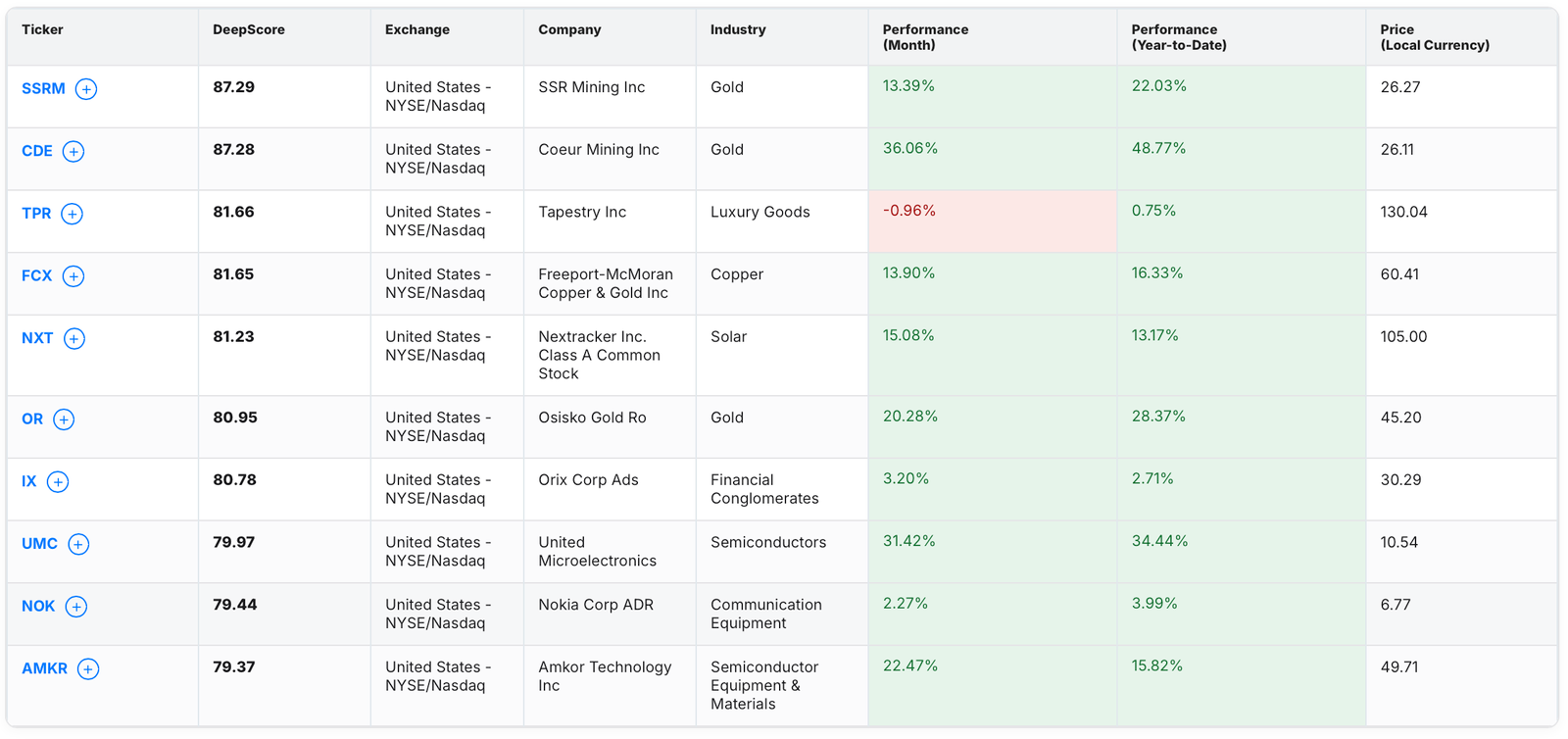

DeepList

Our top stocks picked by DeepCap AI that have the highest probability of beating the market. Additionally, each pick has been thoroughly vetted by our experienced financial analysts.

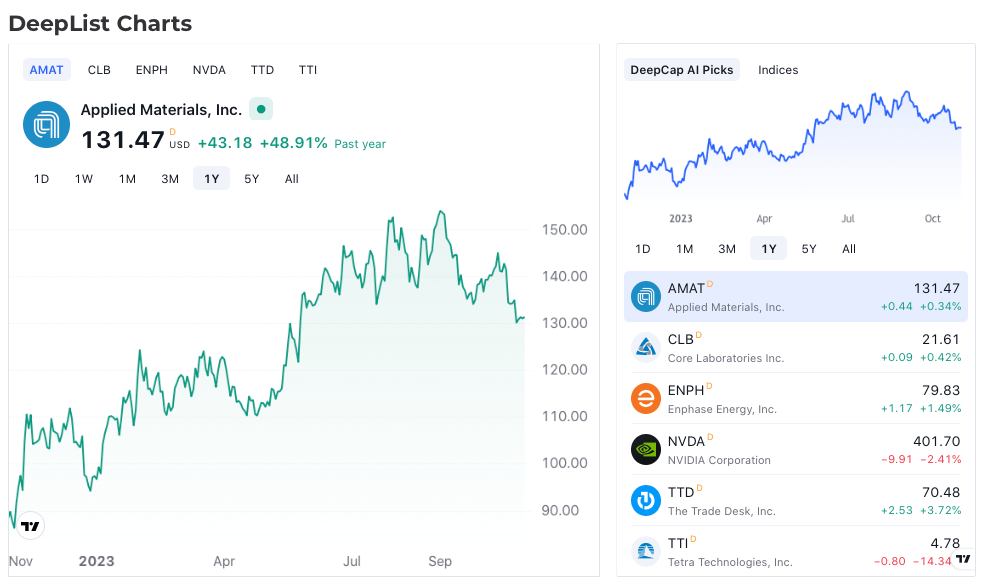

Charts

Detailed charts to track each pick’s past performance over various time frames.

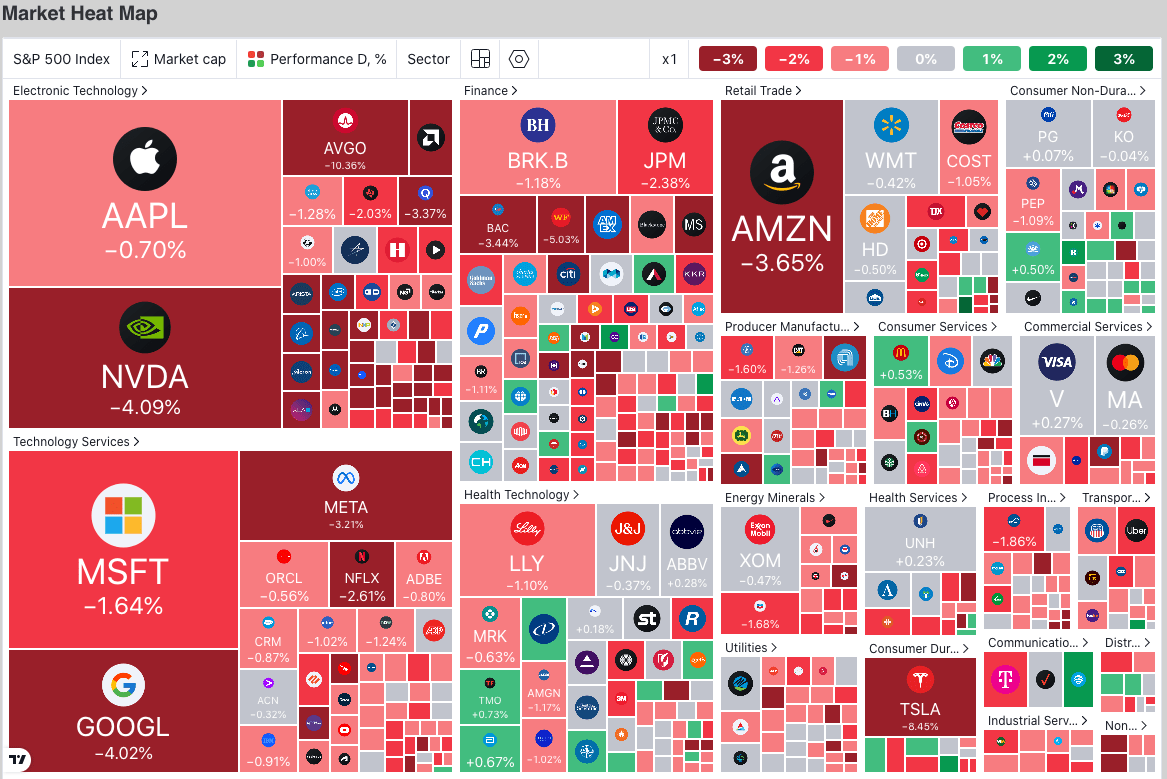

Market Heatmap

Quickly see an overivew of the current market trading day, to help understand the backdrop and overall sentiment of the day.

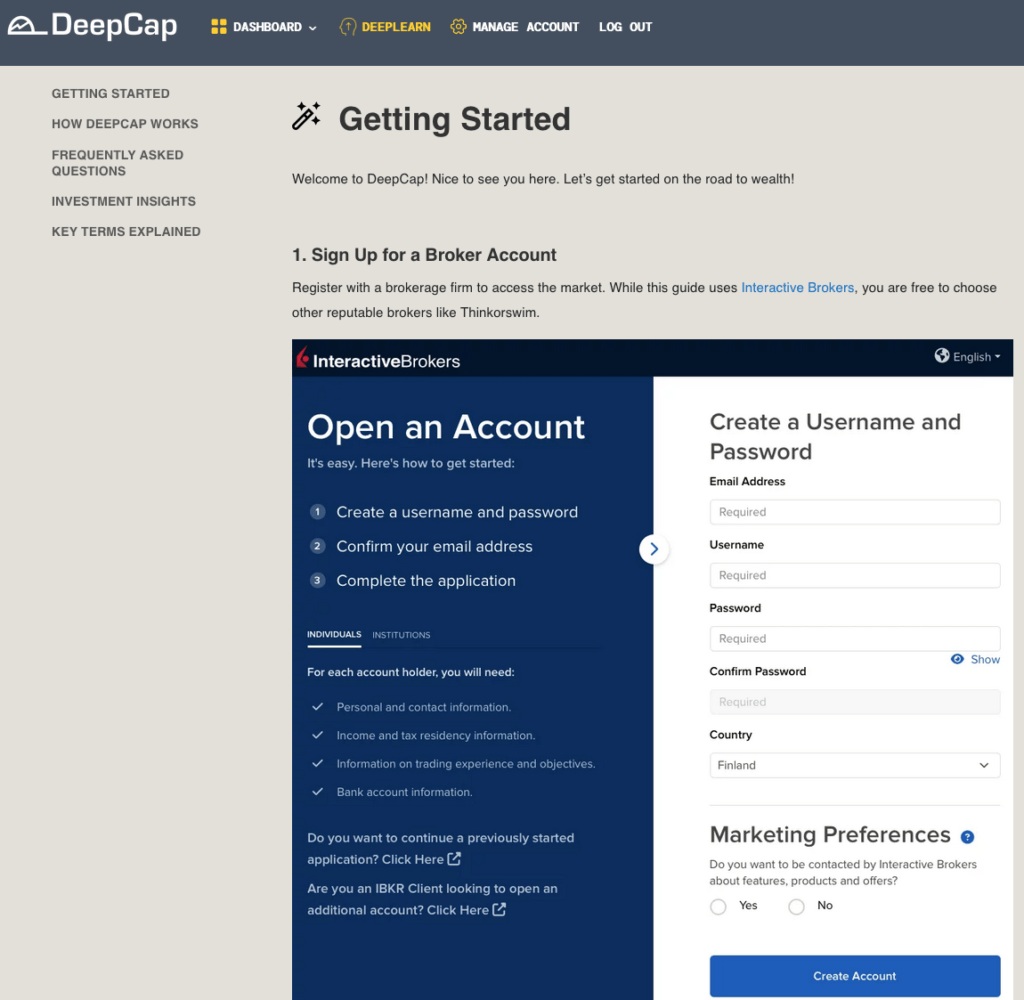

DeepLearn

Picking the right stock to beat the market is just the first step. Trading entries, portfolio re-balancing, money management, psychology – there’s so much more that determines success,

Investing the DeepCap Way: Tutorials and walkthroughs on how to use our stock picks to develop investment strategies that will consistently outperform the market year after year.

Regardless of whether you are completely new to the stock market, or a trading veteran with years of experience, the strategies and methods to implement and take advantage of our DeepList will surely benefit every type of investor.

We also cover on how to avoid investing pitfalls and psychological failings. Decades of real trading experience distilled into easy-to-follow rules and pointers.

Timely Alerts & Updates

We’ll notify you via the dashboard, app (coming soon), and email whenever there are updates to the DeepList, or when important analysis that could impact your portfolio get released.

You’ll also receive updates on key market events like earnings, Fed announcements, sector shifts, and notable sentiment or activity we believe could impact your investments.

Performance Figures that Speak For Themselves

Deepcap’s Performance